These are things we all need and use in our daily lives so we have to make this budget allocation for them.

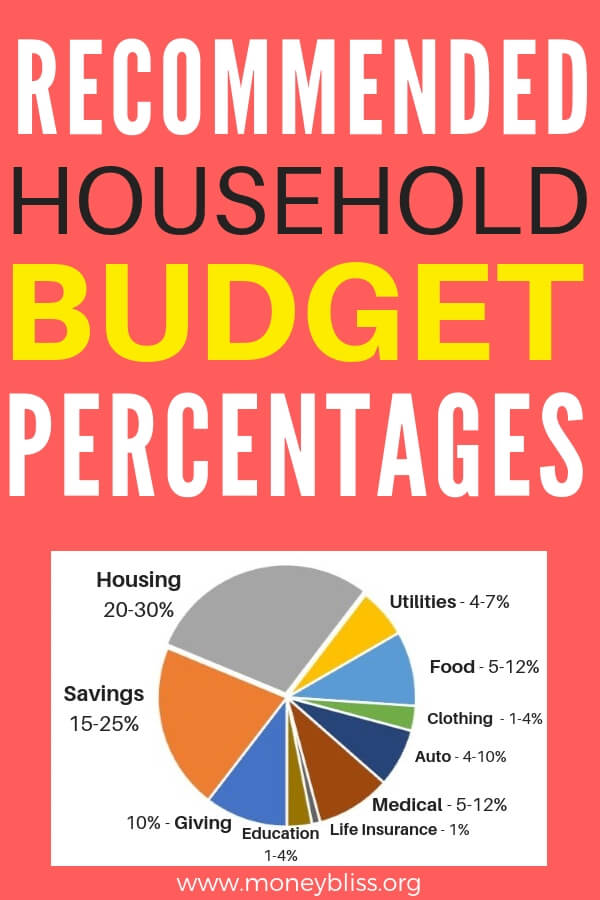

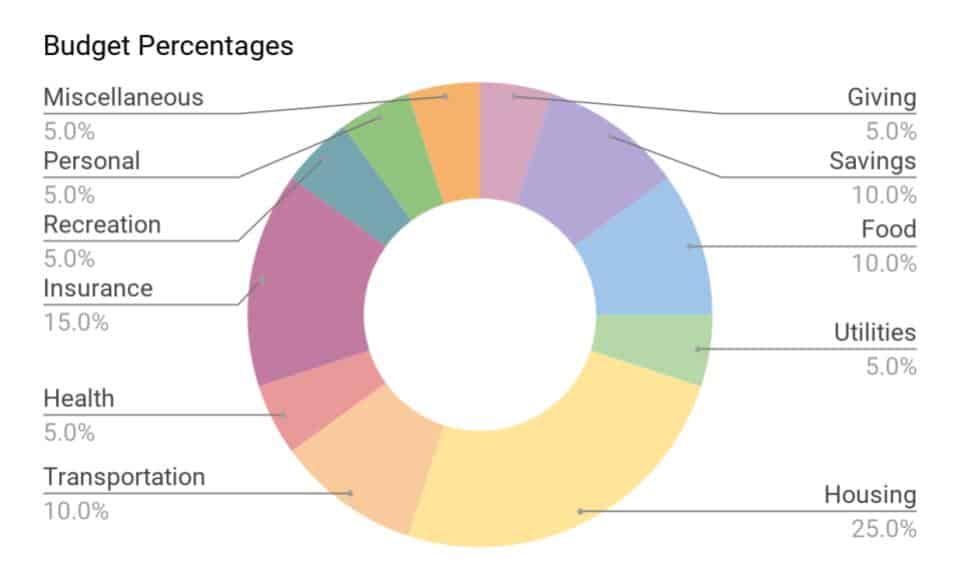

This includes your electricity, water, natural gas or propane, trash services, phone, cable, and Internet. This will also ensure that you can still have enough to budget for other categories. You don’t want to be stuck paying a huge amount for your mortgage every month – no matter how nice the place may be. Many banks will approve you for more than this, but being house poor is not fun! When it comes to the percent of your budget for housing, make sure you don’t go over. The housing category involves your rent, mortgage including tax, insurance, or homeowners association fees. By doing meal planning, you will actually also avoid those unexpected restaurant trips since you have prepared ahead of time. This will allow you to control your eating out costs. When it comes to eating out in restaurants, you can also budget to only do that once a week, for example. When you have a list and a goal and you can control yourself from buying unnecessary things (I’m looking at you family-pack of Oreos). You can do weekly meal plans so that you would know what exactly you are going to buy from the grocery and how much it would all cost. One way you can control your spending is to do meal planning. Sometimes this can be hard to stick to, especially if you tend to eat out often. This category involves groceries as well as eating out. Once you are out of debt, you can start to invest 15% of your budget for savings. When building your wealth, you can also start to save up for your retirement.

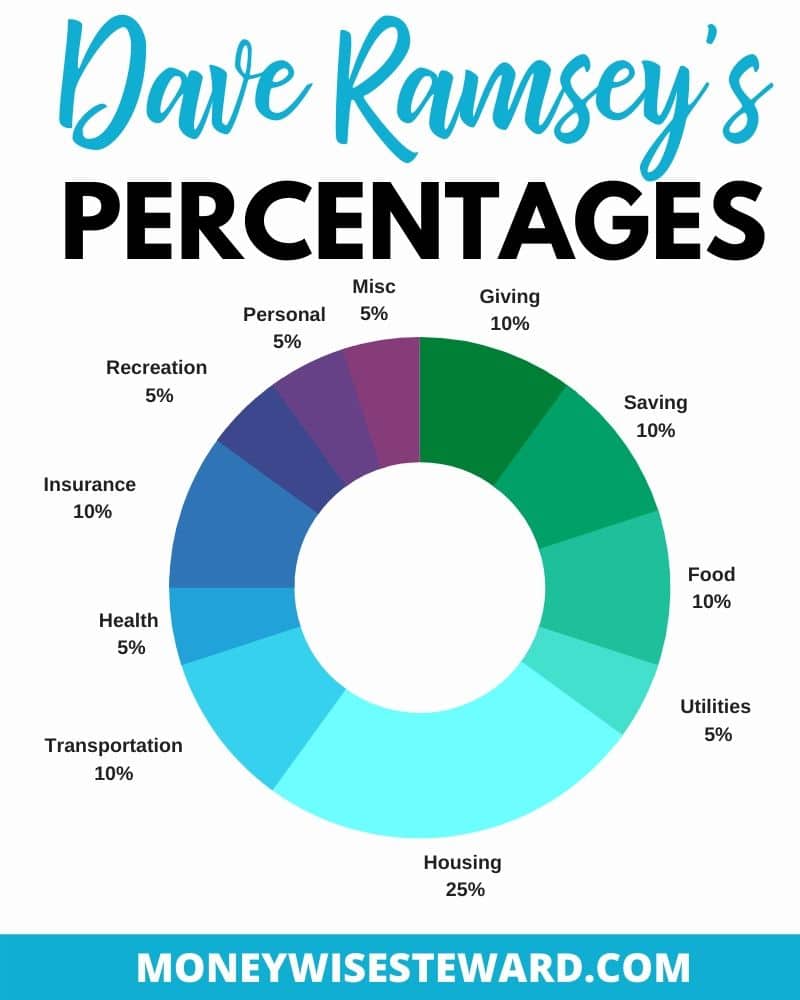

These take a large sum of money but if you have saved for them, it is an easy transition into the next step. Try to put in $1,000 in the beginning.īy having an emergency fund you won’t need to get in debt when you get into a sticky situation.Īt some point in life, we typically like to make big purchases or investments like getting a new car or buying a house. It is suggested to invest in a starter emergency fund as a sort of protection for you in case anything happens. Having savings is crucial for unexpected emergencies, for big purchases, and in order to build your wealth. At different points in your life, you may have more or less to put in your savings so it would really depend on your current situation. This is why it is important to get out of debt, so that you’ll have more to allocate towards your future. If we you are carrying a lot in debt saving can feel impossible. In reality, we probably don’t save as much as we want to. When you give back to others, you aren’t only helping them, but you are also helping yourself become a better person. When you are satisfied with what you have – even if it isn’t a lot – you can truly feel happy. Giving back is important because it teaches you to be grateful for what you have. This can either be through donations to charities, church, organizations, or worthwhile causes you may support or believe in. They can also act as a benchmark to make sure you are on your way to financial freedom and not debt. These percentages are there to help guide you with your own budgeting for your household. When you plan your cash flow, you can ensure you have control over your finances and money doesn’t slip away from you. What factors determine your household budget percentages?.

0 kommentar(er)

0 kommentar(er)